Introduction

The year 2020 has proved to be nothing like anything the world has ever experienced before. The onset of the ongoing COVID-19 pandemic that was fast spreading and taking lives, saw businesses quickly close down and others readjust their operations to cope with the new circumstances. Banks and the entire financial industry were not spared. Governments across the world continue to support banks and other businesses to adjust to the new normal, in meeting the needs of their customers, while adjusting and coping with the challenges brought about by the pandemic.

In the midst of all the challenges, the need to manage and effectively leverage customer’s data has been paramount. The financial sector suffers from inaccurate data. This inaccurate data, during the COVID-19 pandemic, has the potential to hinder the survival and success of the sector.

Research by Experian shows that half of the organizations consider their CRM data to be unclean and can effectively leverage it. This is a significant level of data inaccuracy that has affected the financial sector in these ways;

● Operational risks

Inconsistent data in the financial sector leads to fraudulent transactions. Dirty data risks the operations of an organization and its reputation may get damaged as a result.

● Poor strategic decisions

Dirty data can easily lead to the executives making poor strategic decisions. Dirty data brings up trust issues in it and the executives may be compelled to look elsewhere to base their decisions, other than their data.

● High data costs

Globally, inaccurate data costs organizations between 15 and 25% of their total revenues. Gartner reports that in the year 2017, global banking revenues were in excess of $2.2 trillion, meaning that inaccurate data cost the banks in excess of $400 billion on that year alone.

Data quality tools

What are data quality tools? These are processes and technologies that identify, understand, and correct flaws in data to enhance effective data governance across operational business processes and strategic decision-making. These solutions feature a wide range of important functions, including profiling, standardization, parsing, cleansing, matching similar data, enrichment of available data, and finally, monitoring it.

Here are the tips to choose the right data quality tools.

What is the current situation?

The financial sector is in a state of flux. Though slowed down by the devastating effects of the ongoing COVID-19 pandemic, the sector heavily relies on intelligent decisions on how best they can improve their services to better serve their customers. The heart of making intelligent decisions simply lies in quality data.

Most of the businesses in the sector had already started implementing data governance structures and IT infrastructure to enable them to process large amounts of data in a timely manner. The ultimate goal of implementing these initiatives was to produce better quality data in order for the market trends as well as risks to be identified early enough to avoid a crisis.

Dirty data is slowing the sector down. The cost impact of dirty data is huge, but an organisation can avoid the loss if it takes the proper strategy. Clean and reliable data makes a business more responsive to their customer needs while cutting down wasted efforts by data scientists as well as knowledgeable employees.

Quality data is cleaned, assured, and guaranteed by data quality tools. Data quality tools have proved to be very helpful for the financial sector during the ongoing pandemic in these ways;

1) Digital transformation

The COVID-19 pandemic has accelerated the digital transformation of the corporate world, including the financial sector. Employees have been forced to work from home or work remotely in an attempt to contain the quickly spreading virus. The digital transformation journey cannot be achieved if controls are not in place to ensure high data accuracy and reliability. These are well assured by good data quality tools.

2) Better understanding of customers

The financial sector has heavily relied on effectively segmenting their customer bases. This has always been fueled by the need to understand each customer segment’s value. The financial sector is always actively seeking to stay relevant to their customers and stay responsive to their ever-evolving needs. Accurate, complete, holistic, and quality data can help the sector connect more and better with their customers.

Read the benefits of maintaining high quality data.

3) Enhance effective communication

The ongoing pandemic exposed businesses, including the financial sector to managing communication during a crisis. The onset of the pandemic saw a lot of confusion brought about by nobody knowing how the virus was evolving. Businesses were monitoring the situation and being forced to make quick strategic decisions. These decisions had to be communicated with their customers. This is still the case todate. Complete, clean, and up to date customer data was and continue to be crucial to the financial sector in managing communication with their customers and other stakeholders.

4) Ease compliance

The financial sector is heavily regulated owing to the crucial customer data and finances they handle. There are many regulations affecting the sector and the players have to comply with the regulations including the Protection of Personal Information (PoPI) Act, among similar regulations. For compliance purposes, customer data needs to be of adequate quality to enhance effective decision-making.

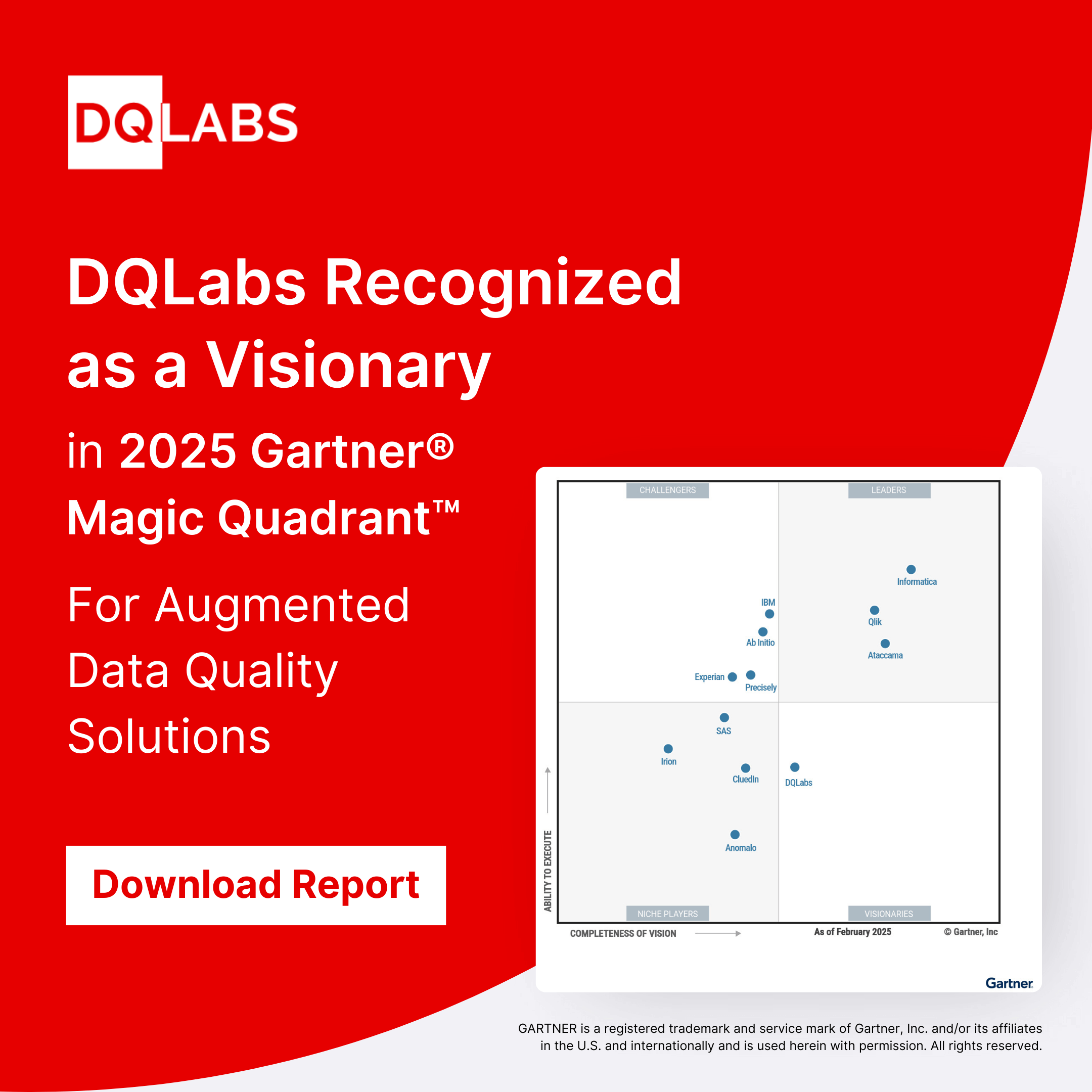

The issue of money laundering is a big concern in the financial sector. The anti-money laundering measures put in place across the sector need verification of customers’ information and transaction data. The measures also require this data to be accurate and accessible. Accurate data is assured and cleaned by data quality tools like the DQLabs.

Summary

The financial sector needs quality data to better understand their market and customers. Quality data is also crucial in strategic decision-making and communication. The year 2020 has seen an unprecedented disruption in the financial sector due to the ongoing COVID-19 pandemic. The pandemic has caused a devastating effect on lives and businesses. Quick strategic decisions have had to be made across the sector as the situation unfolds. High-quality data has proved to be very important for the sector in handling the pandemic. Luckily, the availability and effectiveness of data quality tools such as DQLabs has ensured that the financial sector is assured of high-quality data. The data quality tools leverage on modern and transformative technology including machine learning, artificial intelligence, and big data.

Get a demo of AI/ML augmented data quality.